Financial technology has come a long way in recent years, enabling better and cheaper access to banking services for millions. Perhaps one of the biggest driving forces behind this has been the proliferation of Banking-as-a-Service (BaaS) providers.

BaaS makes it easy for any business to provide the financial services traditionally offered by a bank, such as current accounts, credit cards and loans. Firms using BaaS access core banking infrastructure over APIs rather than having to build it themselves. This significantly reduces the time and resources needed to develop new financial services on top.

There are many well-known brands using BaaS today such as Chime, Monzo and Revolut. It’s also prevalent across non-financial brands like Uber Money and Apple Card.

While BaaS providers have quickly altered the financial landscape across basic banking services, they do not tend to cater for more complex solutions like investments. Specialist Investment-as-a-Service (IaaS) providers have emerged to fill this gap, sharing similar principles with BaaS.

Investment-as-a-Service is the provision of core investment technology and services enabling any business, from startups to established platforms, to offer a range of investment experiences.

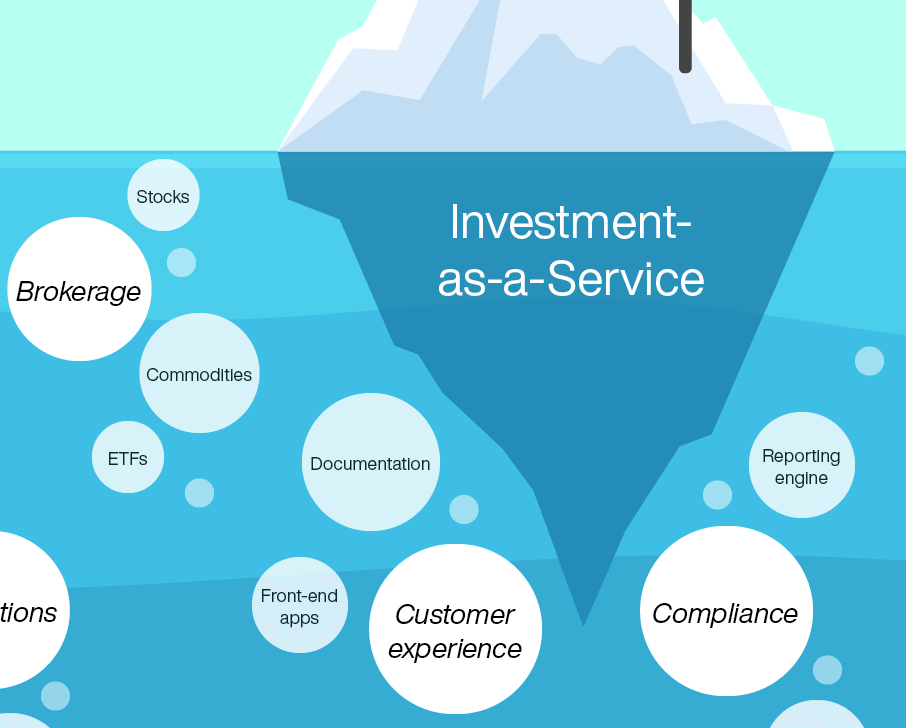

Investment firms want to focus on providing a great experience to their customers – the tip of the iceberg. Beneath the surface, the complex network of investment technology and infrastructure is taken care of by IaaS providers.

The need for IaaS

Retail investing has experienced sustained growth in recent years, driven by digital advancements, lowering of fees, and participation from younger generations like millennials and Gen-Z. Fund ownership among EU households reached EUR 3.2 trillion in 2022, compared to EUR 1.7 trillion in 2012, according to the EFAMA’s latest fact book.

Businesses looking to capitalise on the increasing demand for modern investment solutions face several challenges. Building the necessary infrastructure is time consuming and expensive. The complexity of investments also requires expertise and technology to be pooled together from different areas.

It is not feasible for startups and new market entrants to do this themselves if they want to go to market quickly, minimise risk, and ensure high compliance standards.

IaaS isn’t just removing barriers for new market entrants. The wealth management sector has been slow to digitalise compared to other areas of finance. Established firms are grappling with legacy technology and processes that make it difficult to innovate and launch new products. These firms are not typically “large businesses with massive IT budgets,” according to Leon Deist, CIO at wealth management firm Quilter – commenting in our recent Digital Transformation in Investment Management report.

Thanks to the modularity of IaaS solutions, established players can pick and choose the functionality they need and easily integrate this with their existing tech.

Who is adopting IaaS?

IaaS can be employed by any company that wants to offer innovative investment experiences. It is used today by traditional and digital banks, fintechs platforms, startups, wealth and asset managers.

Since BaaS gave rise to several neobanks around the world, it is perhaps unsurprising that this segment has already adopted IaaS as it’s go-to method for expanding into investments. Out of 61 European neobanks we analysed, 59% of those offering investing use an IaaS provider. The majority of others are owned by large incumbent banks with proprietary technology.

IaaS is helping firms generate valuable new revenue streams. Revolut reported its first full-year profit in 2021, with more than half its revenues generated by foreign exchange and wealth services.

As with BaaS, non-financial companies also stand to benefit from this technology. By embedding investment services within existing customer environments, companies can offer relevant services at the time of need. This is part of a wider practice known as embedded finance.

The use cases for non-financial firms are virtually unlimited. Elon Musk recently told X employees about his ambitions for the platform to become a financial hub: “If it involves money. It’ll be on our platform. Money or securities or whatever”. Musk went on to add that “It would blow my mind if we don’t have that rolled out by the end of next year”.

Not all IaaS solutions are equal

The IaaS landscape is varied and dynamic, with providers bringing distinct features and value to the integration of financial services. There are two main types of company offering IaaS today: business-to-consumer (B2C) investment firms and dedicated IaaS providers.

B2C investment firms are leveraging their wealth technology by leasing this out to other businesses. This model is already widespread in the BaaS sector, with the likes of Starling Bank launching its BaaS in the UK in 2018 alongside its retail banking services.

On the other hand, companies like Huddlestock focus on providing dedicated IaaS solutions to clients.

One consideration when working with B2C investment firms is the chance that you could end up competing for business. The products and services they can enable your company to provide will usually match their own, making it difficult to differentiate and attract new customers.

Since IaaS is an umbrella term for different investment technology and services, it is important for firms to consider the specific functionality and support they need to achieve their goals. For example, a firm that wants to be able to offer investing in stocks, mutual funds and commodities should make sure the IaaS provider caters for those instruments.

Aside from product features, there are also several services that could be useful to a company launching a new investment product, such as regulatory umbrella services and operations outsourcing. Not all IaaS providers offer this depth of coverage and this could end up being critical to success.

If you’d like to discuss the goals for your wealth management project, get in touch with our experts.