In recent years, investment funds in Europe have mainly been sold to retail investors through intermediaries like banks, financial advisors, and insurers. It’s been rare for fund managers to sell their funds directly to consumers (D2C) due to the regulatory obligations, complex financial infrastructure and administrative processes involved. However, this is changing thanks to financial technology, with fund managers now believing that digital platforms will play a significant role in reshaping distribution over the next five years. Here, we explore the main drivers behind D2C distribution and how one fund manager successfully launched a consumer platform, attracting over 100k users.

Fund distribution trends in Europe

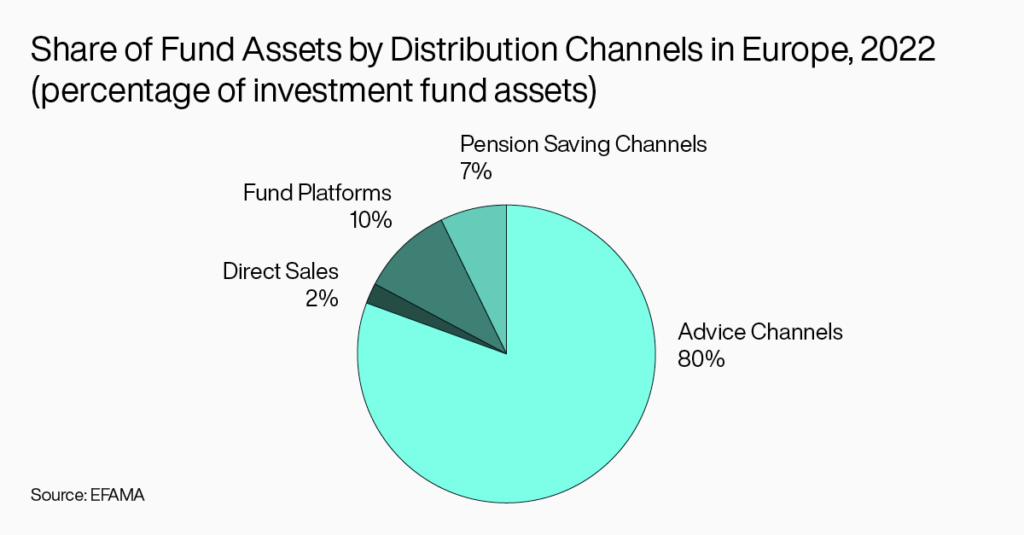

To understand D2C distribution, it’s helpful to look at the current fund landscape in Europe. The latest EFAMA research shows that advice-based distribution channels (like banks and financial advisors providing investment guidance) account for 80% of fund assets owned by European retail investors, while direct sales make up just 2%.

Despite the dominance of advice-based channels, national differences are significant. For example, in Sweden, pension savings account for 43% of fund distribution, compared to the European average of 7%. In Norway, fund distribution is more evenly spread among channels, including fund platforms (24%) and direct sales (16%).

Looking ahead, European fund managers expect digital platforms to play a major role in evolving distribution channels, according to EFAMA’s survey respondents. Financial technology advancements are the main driver behind this shift, presenting promising opportunities for fund managers to own these platforms and attract digitally savvy young investors.

Opportunities with D2C fund distribution

Fund managers are well positioned for D2C distribution since mutual funds are an accessible investment option that fits well with modern retail investment apps. Implementing a direct sales channel opens up several opportunities for fund managers:

Direct client relationships

The prevalence of business-to-business (B2B) models has led to a situation where fund managers know very little about their end customers. A D2C strategy allows firms to establish direct client relationships and build a thriving customer community with meaningful engagement. Connecting with end customers is vital for firms to be able to understand their preferences and needs, meet evolving expectations, and build brand loyalty and trust.

Investor insights

Consumer behaviour and transaction data are valuable assets. D2C models allow fund managers to access this information, helping them stay on top of investment trends, informing product and marketing strategies, and leading to higher conversion and retention rates.

New revenue streams

D2C platforms enable firms to tap into new market segments and attract customers they might not reach through traditional channels. While 80% of fund assets are distributed via advisory channels, not everyone wants or can afford full advice. The rise in DIY investing, particularly during the COVID-19 pandemic, has had a lasting impact, with less than a quarter of British investors using a financial adviser.

Scalability

Digital investment infrastructure makes the D2C model highly scalable through process automation and the ability to quickly expand the product offering. Fund companies can grow their audience quickly without significantly increasing administrative processes or costs.

Market positioning

D2C models allow firms to target specific customer segments and capitalize on trends more effectively. For example, EFAMA survey respondents noted that distributors responding effectively to the growing demand for ESG products are likely to attract a larger share of investment flows.

Future proofing

By implementing a direct sales channel, fund managers can take control of their distribution. Without heavy reliance on intermediaries, fund managers can directly influence their targeting and propositions over time, and remain agile when responding to changing market conditions.

How fintech is enabling direct fund distribution

The investment industry has seen several D2C digital platform launches recently, such as M&G Wealth’s &me and AJ Bell’s Dodl. While some firms develop their own solutions or acquire digital platforms, a more accessible route to market is by using an Investment-as-a-Service (IaaS) solution.

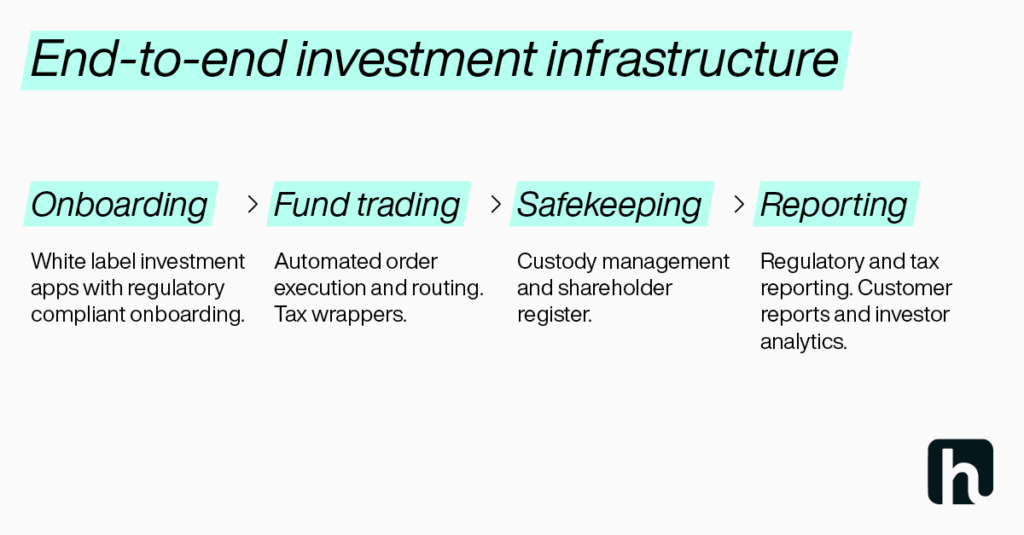

With IaaS, fund managers get access to everything they need to deploy their own digital investment platform, including a white-label front-end experience, regulatory-compliant onboarding, order execution, safekeeping, and reporting solutions. Compared to developing or acquiring digital platforms, IaaS typically offers a faster route to market with little to no upfront costs, making it a great option for fund management companies of all sizes.

IaaS solutions typically come with APIs, allowing fund managers to integrate with preferred third-party suppliers like payment service providers and transfer agents. This approach lets fund managers adopt a cost-effective, client-centric strategy, ensuring seamless digital onboarding and transaction processing. By removing barriers to D2C fund distribution, firms can focus on targeting new segments, building client relationships, and fostering asset growth.

How Nowo scaled D2C fund distribution to 100k+

Nowo, a Swedish fund manager, launched its own digital savings app to capitalise on the D2C opportunity. Its platform offers several unique ways for individuals to build wealth and plan for the future, with savings invested seamlessly in Nowo’s Global Fund. The company also offers free personalised pension advice and savings tips.

While the Nowo team decided to develop their own front-end application, they teamed up with Huddlestock for its Investment-as-a-Service solution. This equipped Nowo with all the investment infrastructure needed to power their app, providing regulatory compliant onboarding, order execution, safekeeping and reporting. Nowo integrated with Huddlestock’s platform via API and was able to implement their preferred payment service provider and transfer agent, resulting in a highly cost-effective solution.

Since integrating Huddlestock’s platform, Nowo has successfully scaled its D2C platform and now manages savings and investments for over 100,000 customers.

Introducing D2C platforms doesn’t mean sidelining existing intermediary channels but rather adding another layer to a fund manager’s distribution strategy. Deploying direct sales channels can set fund managers up for long-term success, making them relevant to new generations of investors. Financial technology has removed barriers to entry for fund managers of all sizes, and in the coming years, the D2C landscape is likely to continue growing.